Facts About Insurance In Toccoa, Ga Revealed

Facts About Insurance In Toccoa, Ga Revealed

Blog Article

The Facts About Health Insurance In Toccoa, Ga Revealed

Table of ContentsThe 8-Minute Rule for Commercial Insurance In Toccoa, GaThe Greatest Guide To Life Insurance In Toccoa, GaWhat Does Automobile Insurance In Toccoa, Ga Mean?4 Simple Techniques For Final Expense In Toccoa, GaThings about Annuities In Toccoa, GaThe Main Principles Of Health Insurance In Toccoa, Ga The 5-Minute Rule for Insurance In Toccoa, Ga

An adjustment in insurance policy costs or terms, as well as changes in income, health and wellness, marriage status, terms of employment, or public policies, can trigger a loss or gain of medical insurance coverage. For concerning one-third of the uninsured population, lacking protection is a short-term or one-time interruption of coverage, and the typical period of a duration without insurance is between 5 and 6 months.Since the mid-1970s, development in the cost of medical insurance has exceeded the increase in real revenue, creating a gap in purchasing capacity that has added about one million persons to the ranks of the without insurance yearly. In spite of the financial prosperity of recent years, in between 1998 and 1999 there was just a minor decline in the numbers and percentage of without insurance Americans.

The Definitive Guide for Medicare/ Medicaid In Toccoa, Ga

In certain, current researches that evaluated adjustments in states that broadened Medicaid compared to those that didn't highlight the value of coverage. Adult Medicaid enrollees are five times more probable to have routine resources of treatment and four times most likely to obtain preventative treatment solutions than people without protection.

Not known Details About Insurance In Toccoa, Ga

Additionally, low-income kids with moms and dads covered by Medicaid are most likely to obtain well-child check outs than those with without insurance moms and dads. A higher percentage of individuals in Medicaid development states have a personal doctor than those in nonexpansion states. People with coverage are most likely to acquire access to prescription drug therapies.

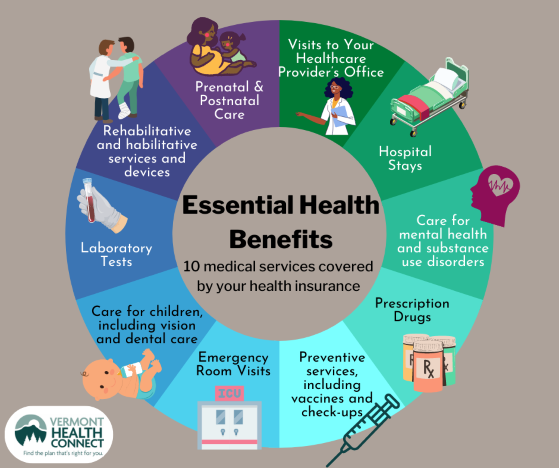

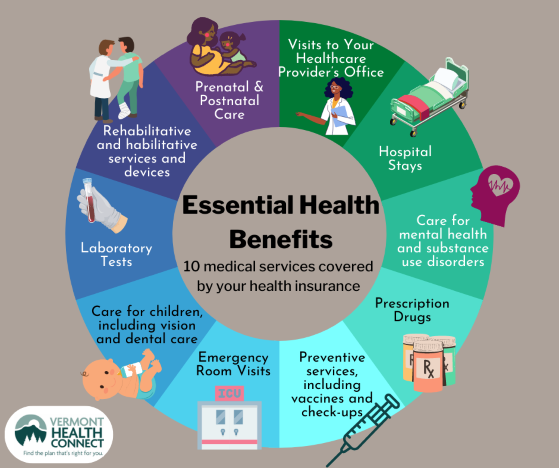

Protection improvesaccessibilityto behavior health and compound use problem treatment. Insurance coverage reduces price barriers to accessing treatment. Coverage expansion is linked with decreases in death.

Health Insurance In Toccoa, Ga Things To Know Before You Get This

Insurance policy standing also differs by race and ethnicity. The high price of without insurance places tension on the wider health and wellness care system. Individuals without insurance policy put off needed care and depend much more heavily on medical facility emergency departments, resulting in scarce sources being directed to treat conditions that often might have been avoided or taken care of in a lower-cost setting.

Information concerning where to go online to evaluate and print duplicates of full wellness strategy records Where to find a listing of network suppliers Where to find prescription medication coverage details Where to discover a Reference of Wellness Coverage and Medical Terms(likewise called a" Attire Reference ") A contact copyright with questions A statement on whether the strategy meets minimum vital insurance coverage(MEC)for the Affordable Treatment Act(ACA)A declaration that it meets minimum worth(strategy covers at the very least 60 percent of medical costs of benefits for a populace on standard)You can ask for a copy of an SBC anytime. Learn how specific health insurance policy plans cover females's health care solutions, including maternal, contraception and abortion. Millions of Americans would certainly have even worse wellness insurance coverage or none at all without Obamacare.

4 Easy Facts About Affordable Care Act (Aca) In Toccoa, Ga Explained

Find out just how the Affordable Treatment Act(Obamacare)boosted individual wellness insurance coverage and supplied strategy affordability with aids, Medicaid expansion and various other ACA official statement arrangements. These alternatives can include medical, oral, vision, and much more. Discover if you are qualified for protection and enlist in a strategy with the Marketplace. See if you are qualified to utilize the Health Insurance policy Industry. There is no earnings limitation. To be qualified to register in health and wellness insurance coverage via the Industry, you: Under the Affordable Treatment Act(ACA), you have unique person defense when you are guaranteed via the Health Insurance Coverage Market: Insurers can not reject protection based upon sex or a pre-existing condition. https://www.inkitt.com/jstinsurance1. The healthcare legislation supplies legal rights and securities that make coverage much more fair and understandable. Some rights and securities put on plans in the Health and wellness Insurance Coverage Marketplace or other private insurance policy, some put on job-based strategies, and some relate to all health and wellness insurance coverage. The protections detailed listed below may not use to grandfathered health and wellness insurance prepares.

With medical prices soaring, the demand for private health insurance policy in this day and age is a financial truth for lots of. Within the category of personal

health health and wellness, there are significant differences between a health wellness took care of (HMO)and a preferred favored carrierCompanyPPO)plan. Of program, the most obvious advantage is that exclusive wellness insurance policy can give coverage for some of your healthcare expenditures.

Several specific plans can set you back a number of hundred dollars a month, and household protection can be also greater - Automobile Insurance in Toccoa, GA (http://www.travelful.net/location/5368304/united-states/thomas-insurance-advisors). And also the extra comprehensive policies included deductibles and copays that insureds have to meet before their protection begins

Report this page